The three types of budgets are operating, capital, and cash budgets. Operating budgets are used to forecast revenue and expenses for day-to-day operations, while capital budgets are used to plan for long-term investments and improvements.

Cash budgets are used to track cash flow and ensure there is enough cash on hand to cover expenses. Budgeting is an essential part of financial planning, whether it’s for a business or an individual. Without a budget, it’s challenging to control spending, plan for future costs, and achieve financial goals.

Understanding the different types of budgets is crucial to creating an effective financial plan. Operating budgets are typically prepared for a year and serve as the basis for the company’s profit and loss statement. Capital budgets, on the other hand, look further into the future, outlining major expenditures such as equipment purchases or expansion plans. Finally, cash budgets track inflows and outflows of cash, ensuring there is enough liquidity to cover daily expenses and any unexpected costs.

Credit: www.businesstoday.in

The Three Types Of Budgets

Overview Of The Three Types Of Budgets

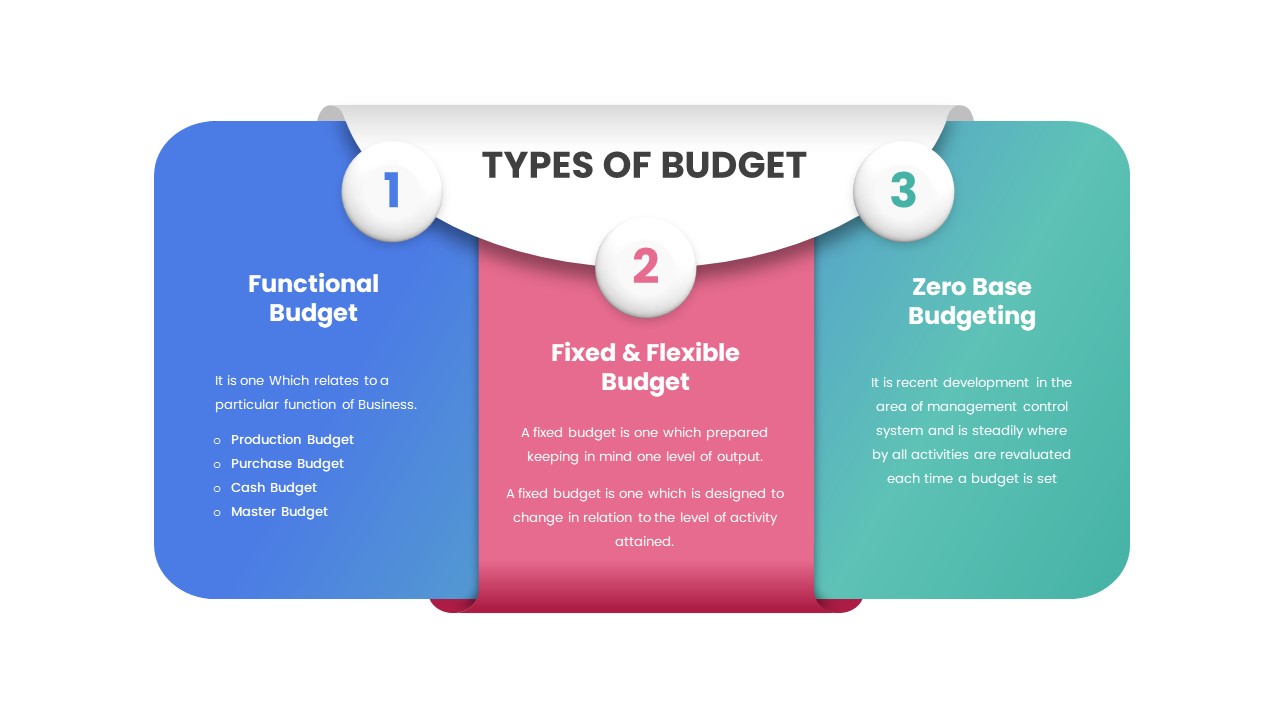

Budgets are an essential element of business planning, which is why they come in different forms. No one-size-fits-all solution exists for budgeting that suits businesses of all shapes and sizes. There are three types of budgets that businesses typically use: fixed budgets, flexible budgets, and incremental budgets.

Understanding the nuances of each type of budget is crucial to ensure that businesses keep track of their finances and work towards their financial goals.

Fixed Budgets

Fixed budgets are the simplest type of budget template that businesses use, which account for expenditures based on predetermined income and expense ratios. Predetermined ratios do not change, even if sales are more or less than planned, meaning that fixed budgets are typically static.

Let’s take a closer look at the definition, characteristics, advantages, and disadvantages of fixed budgets.

Definition And Characteristics:

- Predetermined ratios are used for tracking income and expenses

- The budget is created using past sales data and fixed income ratios

- Remains static even if there are any changes in sales or revenues.

- Suitable for businesses with stable sales or revenue.

Advantages And Disadvantages:

- Easy to understand and implement.

- Strict measures help reduce unnecessary spending.

- Minimal, if any, changes take place within business processes.

However:

- Lacks flexibility to adjust to unexpected changes in the market or industry.

- Not suitable for businesses with fluctuating sales or revenues.

- Overly strict measures may hinder business growth.

Suitable Industries And Scenarios:

Fixed budgets are suitable for businesses engaged in manufacturing, retail, or service industries. Companies that offer standardized products with limited price variations, with stable sales and revenue, can benefit from fixed budgets.

Flexible Budgets

Flexible budgets prioritize variable costs over fixed costs and allow for a certain percentage of fluctuation in sales, expenses, or revenues. Let’s take a closer look at the definition, characteristics, advantages, and disadvantages of flexible budgets.

Definition And Characteristics:

- Flexibility lies in altering expenditures based on changes and aligning them to goals.

- Using flexible budgets allow businesses to create a framework that considers the impact of changes in sales or revenue.

- It is produced by using past sales data as a benchmark.

Advantages And Disadvantages:

- A flexible approach helps adjust to external uncertainties and competition.

- Expenses are adjusted based on revenue or sales changes, resulting in more accurate financial statements.

- Helps to identify areas with room for cost-cutting measures.

However:

- May require additional time and effort to manage expenses.

- Complexity may lead to confusion or errors.

- Continued monitoring is essential, or overspending may still occur.

Suitable Industries And Scenarios:

Flexible budgets are suitable for businesses with fluctuating sales and varied expenses. Service industries, hotels, and hospitality businesses are examples of flexible budget scenarios that don’t have a fixed pricing structure.

Incremental Budgets

Incremental budgets build upon the previous year’s budget, with the incorporation of changes made during the budget period. Here is a closer look at the definition, characteristics, advantages, and disadvantages of incremental budgets.

Definition And Characteristics:

- Incremental budgets use past expenditures with an influx of any necessary changes made.

- Every budget cycle ends with an incremental addition to the previous budget with any adjustments required to meet future goals.

Advantages And Disadvantages:

- The application is simple, and it saves time when compared to creating a whole new budget plan.

- Reliability can be achieved through the analysis of past data.

- The incremental increment helps allocate accounts based on what was used during the previous cycle.

However:

- The plan may not account for variable factors.

- May allow for complacency in sticking to an inefficient plan.

- May result in duplication or unnecessary expenditure due to the recency effect

Suitable Industries And Scenarios:

Incremental budgets work well for businesses that operate in stable market conditions with little change from year to year, making it suitable for social sector enterprises and government departments conducting long term, multi-year projects.

To sum it up, businesses should choose the type of budget that aligns with their needs, goals, and operating conditions. A business that accurately tracks its finances with an appropriate budget becomes proactive, according to its financial goals.

Differences Between The Three Types Of Budgets

Comparison Of The Three Types Of Budgets

Budgeting is an essential part of managing finances for both individuals and businesses. There are three primary types of budgets that people or entities can utilize: incremental, zero-based, and flexible. Each has its unique features and functions.

How They Differ In Terms Of Flexibility, Predictability, Accuracy, Etc.

When it comes to flexibility, incremental budgeting is the least flexible, while flexible budgeting is the most flexible. Incremental budgeting assumes that the previous year’s budget is the baseline and uses it as the starting point. In contrast, zero-based budgeting requires managers to make a budget from scratch each year, which gives it more flexibility, though it can take more time.

Flexible budgeting allows organizations to adjust their budgets to accommodate unexpected changes throughout the year.

Regarding predictability, incremental budgeting is the most predictable since it assumes that the previous year’s budget is good enough to continue using, while flexible budgeting is the least predictable since it allows for constant changes. Nevertheless, if used correctly and efficiently, zero-based budgeting can provide better accuracy in predicting future expenses than the other two types.

Accuracy is also vital in any budgeting process. Incremental budgeting is the least accurate since it uses the previous year’s budget as the starting point without considering changes in circumstances. Zero-based budgeting, on the other hand, is the most accurate, as it requires managers to analyze every detail of the budget from zero to avoid over or under-budgeting.

Flexible budgeting falls somewhere in the middle in terms of accuracy, as it allows adjustments but also requires some predictability.

Which Industries Or Scenarios May Require One Type Of Budget Over Others

Each type of budget is most suitable for specific industries or scenarios. Incremental budgeting works best for stable companies with a steady stream of revenue, as the budget is already set in place and adjustments are minimal. Zero-based budgeting is ideal for companies with fluctuating revenues as it ensures every expense is accounted for from scratch, setting a more accurate budget.

Flexible budgeting is best for businesses that operate with a lot of unknowns as it can easily adjust to any changes throughout the year.

Choosing which budgeting approach to use depends upon the specific situation or industry. Understanding the pros and cons of each type is essential in making an informed decision that aligns with the goals and objectives of the organization.

Choosing The Right Budget For Your Organization

Factors To Consider When Choosing A Budget

Choosing the right budget for your organization can be a daunting task, especially if you are not familiar with budgeting methods. There are three types of budgets to choose from: zero-based budgeting, incremental budgeting, and activity-based budgeting. Before choosing the right budget, you must consider some essential factors that influence your decision.

Here are some factors to consider when making that decision:

- Organizational goals: Consider your organization’s goals, objectives, and vision when choosing a budget. Identify what you want to achieve in the short and long term to ensure the budget aligns with your objectives.

- Cost and benefit analysis: Consider the cost and benefits of each budgeting method. Cost and benefit analysis will help you determine which budget is cost-effective or cost-efficient for your organization.

- Flexibility: Consider if the budgeting method is adaptable to changing conditions or if it is rigid. A flexible budget can be altered to maintain relevance as changes occur, whereas a rigid budget may become obsolete.

- Time consuming: Consider the time it takes to prepare the budget and compare that time with the available resources. Ensure that the budget is prepared promptly and in the most cost-efficient ways.

How To Determine Which Type Of Budget Is Best For Your Organization

To determine the most appropriate type of budget for your organization, you should consider the strengths, weaknesses, and peculiarities of each budget. Here is what you should know about each budget:

- Zero-based budgeting. This is a budgeting method that considers the organization’s priorities and allocates resources based on priority, regardless of previous budgets. It is best for organizations that need to allocate their resources efficiently.

- Incremental budgeting. This method of budgeting is based on the organization’s historical budget and is adjusted based on changes in priorities. It is suitable for organizations that have a consistent income and expenditure pattern, but may not be ideal for a new or fast-paced organization.

- Activity-based budgeting. This method of budgeting ties activities to costs. It is a budgeting method that calculates each activity’s cost, allowing for more efficient allocation of spending. It is suitable for organizations that conduct different activities that require varying levels of funding.

Tips For Making An Informed Decision

Choosing the right budget for your organization can be overwhelming, but here are some tips to help you make an informed decision:

- Do your research: Learn as much as you can about the budgeting methods to make an informed decision. Once you have a basic understanding of each budget, consider which fits your organizational needs.

- Seek professional advice: Consult a financial expert or advisor. A professional can help you analyze your organization’s specific needs and financial situation to determine the most suitable budget for you.

- Be realistic: Ensure that the budgeting method is realistic and attainable. Avoid being too ambitious, as it may be challenging to achieve. Remember to consider your organization’s resources and financial limitations.

- Consider the future: Consider if the budget is conducive to your organization’s growth and expansion. A good budget should align with business goals and provide a favorable groundwork for organizational growth.

With these tips and a wealth of information at your disposal, choosing the right budget for your organization should be a seamless process. Keep in mind that your budget should align with your organization’s goals and priorities and be flexible enough to accommodate changes.

Budgeting Best Practices

Budgeting is an essential tool that helps individuals and organizations manage their money better. However, creating and maintaining a budget can be challenging, especially for those who are new to the process. In this section, we will discuss some best practices for budgeting that will lead to success.

Common Challenges When Budgeting And How To Overcome Them

Creating and sticking to a budget can be challenging for many people, but there are ways to overcome these challenges. Some common challenges when budgeting include:

- Lack of organization: Creating a budget requires organization, which can be difficult for some. To overcome this challenge, consider using budgeting software or apps to help with organizing expenses and income.

- Difficulty sticking to the budget: Sticking to the budget can be difficult, especially if unexpected expenses come up. To overcome this challenge, leave a buffer for unexpected expenses and use cash instead of credit cards to limit overspending.

- Underestimating expenses: Underestimating expenses can lead to overspending and can throw a budget off track. To overcome this challenge, keep track of all expenses and regularly review the budget to make adjustments as necessary.

Best Practices For Budgeting

To create a successful budget, it is important to follow some best practices. These practices include:

- Set measurable goals: Setting measurable goals is important when creating a budget. This will help individuals or organizations stay on track and identify areas where they need to cut back on expenses.

- Create a comprehensive budget: A comprehensive budget includes all income sources and expenses, including the small ones that may be overlooked. It is important to create a complete picture of finances to help make better financial decisions.

- Review and adjust the budget regularly: Regularly reviewing and adjusting the budget ensures that it is still relevant and accurate. It also helps to identify areas that need improvement and make necessary adjustments.

Tips For Successful Budgeting

To ensure successful budgeting, here are some tips to keep in mind:

- Track expenses consistently: Consistently tracking expenses will help keep a budget on track and identify areas where adjustments need to be made.

- Leave a buffer for unexpected expenses: Leaving a buffer for unexpected expenses will help prevent overspending and ensure that finances stay on track.

- Use cash instead of credit: Using cash instead of credit will help individuals or organizations limit overspending and ensure that they are living within their means.

Frequently Asked Questions For What Are The 3 Types Of Budgets?

What Are The 3 Types Of Budgets?

There are three types of budgets: operating, financial, and capital. Operating budget focuses on day-to-day expenses, financial budget focuses on the overall financial health of the organization, and capital budget focuses on long-term investments.

What Is An Operating Budget?

An operating budget is a short-term budget that projects a company’s revenue and expenses. It focuses on day-to-day expenses such as wages, rent, utilities, and supplies. The goal is to manage expenses and optimize revenue to achieve profitability.

What Is A Financial Budget?

A financial budget takes into account a company’s overall financial health. It includes projections for income, expenses, and investments. This type of budget helps organizations plan for the future and make informed financial decisions.

What Is A Capital Budget?

A capital budget is a long-term investment plan that focuses on large expenditures. It includes projections for building and equipment acquisitions, expansions, and renovations. The goal is to allocate resources effectively and make strategic investments.

How Are Budgets Used In Business?

Budgets are used in business to plan and manage financial resources. They help organizations to allocate resources, track expenses, and manage cash flow. Budgets also enable businesses to make informed decisions about investments and future growth strategies.

What Are The Benefits Of Having A Budget?

A budget helps businesses to stay focused on their goals, manage cash flow, and prioritize spending. It enables companies to identify potential financial problems and take corrective action before it is too late. A budget can also serve as a benchmark for progress and help businesses to measure outcomes.

Conclusion

Now that you are familiar with the three types of budgets, you can decide which one is best for your personal or business needs. The traditional budget is great for those who prefer to have a clear overview of their income and expenses.

On the other hand, the zero-based budget forces individuals and businesses to justify every expense, resulting in a more efficient spending approach. Lastly, the flexible budget allows for fluctuations in income and expenses and is ideal for those with an irregular income.

Regardless of which budget you choose, it is essential to remain disciplined and stick to the set budget to achieve your financial goals. Remember to continuously monitor and adjust your budget accordingly to ensure that you are on track. With the right budgeting technique, you can feel more in control of your finances and achieve your financial aspirations.