To budget and save money, create a detailed budget plan and track your expenses regularly. Maintaining a financial plan can be a challenge for anyone.

However, developing a budget and sticking to it is a vital strategy for achieving financial stability. Budgeting helps you track your income and expenses, allowing you to make informed decisions about where to cut back and where to spend. It is critical to create a budget plan that includes all of your income, expenses, and savings goals.

Once you’ve established a budget, monitor your spending daily to ensure you remain on track. This guide will provide valuable tips on how to budget and save money, ensuring that you achieve financial security and peace of mind.

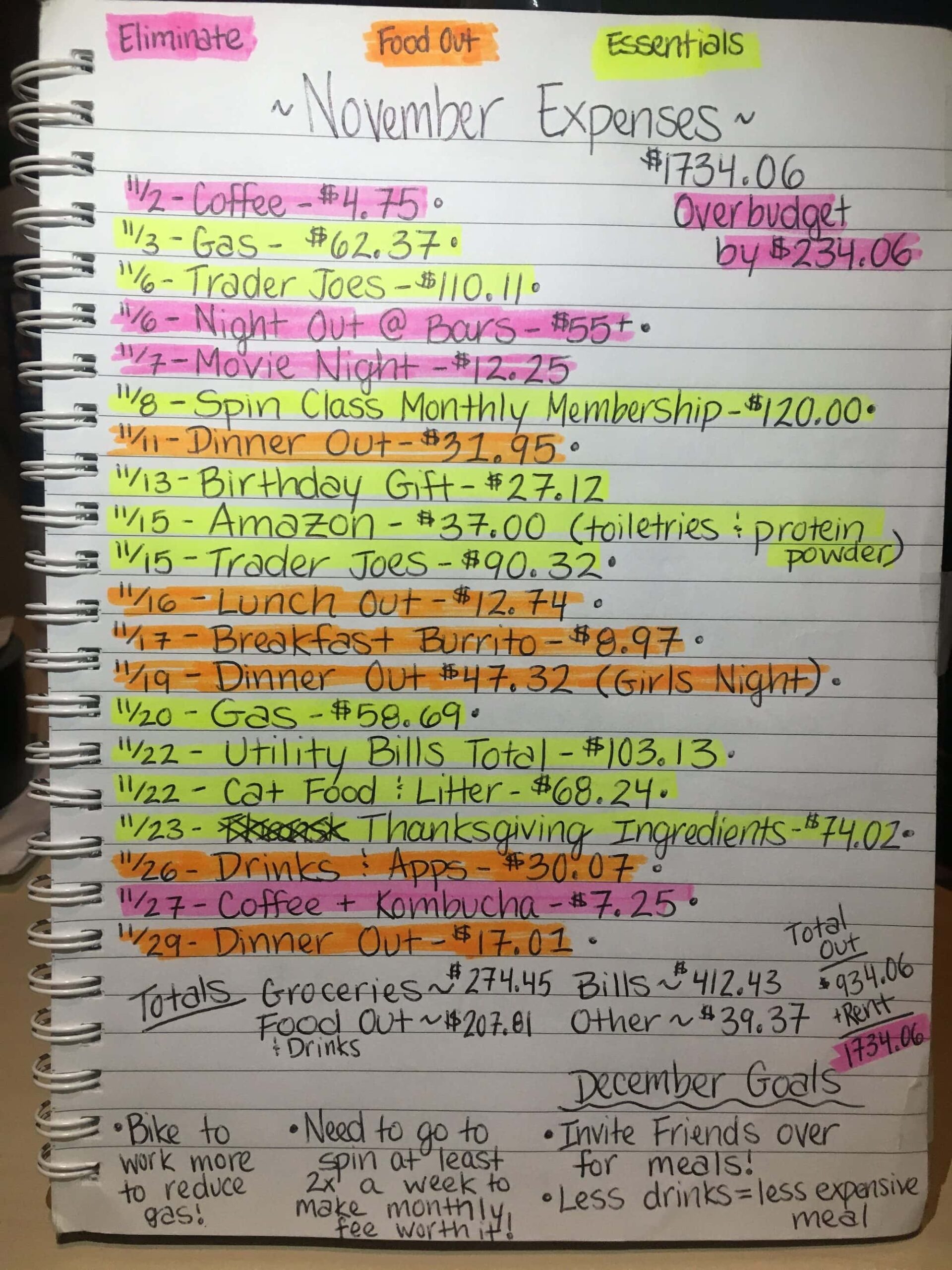

Credit: bearfoottheory.com

Understanding Your Income And Expenses

One of the most crucial steps to budgeting is knowing how much money you have coming in and going out each month. By understanding your income and expenses, you can create a budget that works for your financial situation. Here are some key points to keep in mind.

- Evaluating your income and expenses: Make a list of all your sources of income, including your salary, freelance work, or any side hustles. Next, track your expenses for a month using a budgeting app or spreadsheet. This will help you determine where your money is going and where you may need to make changes.

- The importance of tracking expenses: Tracking your expenses allows you to see where your money is going and identify areas where you can cut back. It also helps you stay accountable to your budget and can prevent overspending.

- Creating a budget based on your income and expenses: After evaluating your income and expenses, create a budget that aligns with your financial goals. Set realistic limits for each category, such as groceries, entertainment, or savings. Don’t forget to include any debt payments or bills in your budget.

- Tips for reducing expenses and increasing income: If you find that your expenses are higher than your income, or you want to save more money, here are some tips to consider:

- Cut back on discretionary spending: Limit eating out, cancel subscriptions you don’t use, or find more affordable options for entertainment.

- Negotiate bills: Call your service providers and negotiate a better rate for your internet, phone, or cable bill.

- Earn extra income: Consider taking on a side hustle, selling unused items, or renting out a spare room.

By understanding your income and expenses, creating a budget that suits your financial situation, and implementing cost-cutting measures, you can reduce financial stress, achieve your goals and relieve money anxieties.

Strategies For Saving Money

Do you struggle to save money or find it difficult to build up your savings? Saving money can be challenging, but with the right strategies and tools, it’s achievable. In this section, we focus on various ways to help you save money, reduce your debt, and plan for emergencies and unexpected expenses.

Setting Financial Goals

The first step in saving money is setting financial goals that align with your long-term financial objectives. You can set specific and realistic goals, such as saving a specific amount every month or paying off your debt by a specific time.

Financial goals can motivate you to save money and track your progress, helping you stay on course.

Creating A Savings Plan

A savings plan is an excellent way to track your spending and saving habits. You can start by calculating your income, expenses, and fixed monthly bills and budgeting accordingly. You can then create a savings plan that could involve saving a fixed percentage of your earnings or an amount that you feel comfortable with every month.

Remember, even a small amount can make a significant difference in the long run.

Automatic Savings And Budgeting Apps

Automatic saving and budgeting apps make it easy to track your spending, set financial goals, and save money. These apps sync with your bank accounts and help identify areas where you can potentially cut costs and budget better. Moreover, you can easily set up automatic savings plans, allowing you to save money without even thinking about it.

Strategies For Reducing Debt

Reducing debt is essential in cutting your expenses and building wealth. You can start small, such as paying off high-interest credit card debt, consolidating your debts, or negotiating with creditors to lower your debt. It’s essential to make debt reduction a priority to build better long-term financial security.

How To Save For Emergencies And Unexpected Expenses

Emergencies and unexpected expenses can occur at any time, and it’s critical to be prepared in case they happen. You can start by creating an emergency fund that should be equal to at least three to six months’ worth of living expenses.

Consider saving a specific amount every month, and don’t touch the emergency fund for any reason other than an actual emergency. Having an emergency fund provides peace of mind and helps in avoiding potential debt traps.

By following these strategies, you can save money effectively, reduce debt, and create a healthy financial lifestyle. Keep track of your progress and adjust your strategy as required, and remember, even small savings add up to a substantial amount in the long run.

Tips For Sticking To Your Budget And Savings Plan

Identifying And Avoiding Common Budgeting Obstacles

Creating a budget is indeed an excellent first step towards better financial planning and saving. However, it can be easy to get discouraged or even frustrated by common budgeting obstacles. Here are a few things to consider when you encounter challenges in your budgeting journey:

- Plan for fluctuating expenses: Sometimes, expenses in your budget may change from month to month. It’s important to make room for some variance in your budget, so you don’t overspend.

- Remain disciplined: While it’s not always easy, staying consistent and disciplined with following your budget is essential. It’s also important to avoid impulsive buying decisions that could wreck your budget.

- Focus on the long-term: Saving and budgeting may not seem that exciting, but don’t forget the long-term payoff. A healthy financial relationship means more of life’s milestones met with confidence and financial stability.

How To Deal With Unexpected Expenses

No matter how well you plan your finances, unexpected expenses still find their way into your life. Here’s what you can do to prepare and deal with these expenses:

- Keep an emergency budget: Maintaining an emergency budget is vital because you never know when an unexpected cost may arise. Make sure it can cover essential expenses like rent, food, and utilities.

- Cover the essentials first: If an unexpected expense arises, start by covering essential bills. Afterward, decide if the other expenses can wait till next month.

- Get creative: Depending on the circumstance, there may be ways to reduce or even eliminate an unexpected cost. Also, consider what luxuries you can live without to save money.

Using Positive Reinforcement And Rewards To Stay Motivated

Sticking to a budget and saving money can be challenging. One way to stay motivated is to positively reinforce your progress. Here are a few ideas:

- Set achievable goals: Setting realistic goals and celebrating when you reach them is an excellent way to keep yourself motivated.

- Celebrate each win: Although small rewards may seem insignificant, they can encourage good habits that will last you a lifetime.

- Create a vision board: Keep your financial goals and reward ideas in sight using a personalized vision board. It encourages you when you need it most.

Adjusting Your Budget As Your Financial Situation Changes

Life isn’t static, and neither should your budget be. Being flexible is crucial, especially to adjust to changes in the economy and your personal finances. Here are a few tips for keeping your budget updated and relevant:

- Check in monthly: Schedule a regular time each month to review your budget. This review allows room for changes in your income, expenses, and priorities.

- Prioritize your goals: Whether it’s paying off debt or saving for a house, when your financial goals shift, your budget must follow suit.

- Finding ways to cut expenses: When making a realistic budget becomes challenging, finding ways to cut costs is essential. Review your household bills and see what you could negotiate or eliminate.

Investing In Your Future

If you want to secure your future, investing your money is a smart decision. It may seem daunting, but with proper research and guidance, you can make profitable long-term investments. Here are some key factors to consider before you start investing:

The Importance Of Saving For Retirement

Retirement may seem far away, but it is never too early to start saving for it. Here are some key points to consider when saving for your retirement:

- Start early: The sooner you start investing in retirement accounts, the more you will accumulate over time.

- Determine how much you need: Calculate your estimated expenses during retirement and set a savings goal.

- Consider all your options: There are various ways to save for retirement, such as 401(k) plans, iras, and annuities. Research the options and consider which one is right for you.

How To Invest In Stocks, Bonds, And Other Opportunities

There are many investment options available, including stocks, bonds, mutual funds, real estate, and more. Here are some key points to consider when choosing where to invest:

- Research: Before investing in any opportunity, research and analyze the potential risks and returns.

- Diversify: Diversifying your investments means spreading your money across various opportunities to reduce risk.

- Evaluate your risk tolerance: Consider how much risk you are willing to take based on your financial goals and personal circumstances.

Managing Risk And Diversification

Making investments always involves some level of risk. However, there are ways to manage risk and minimize potential losses. Here are some points to consider:

- Diversification: As mentioned earlier, diversifying your investments means spreading out your money. It can reduce your risk and increase your chances of earning profits.

- Asset allocation: Allocating your assets involves deciding how much money to put into different types of investments based on your financial goals and risk tolerance.

- Avoid emotional decision making: Don’t let emotional reactions guide your investment decisions. Always stick to your investment plan.

How To Choose A Financial Advisor

Choosing the right financial advisor for your needs is essential. Here’s what you should consider when making your choice:

- Credentials and experience: Look for a financial advisor with relevant credentials and experience in the field.

- Fees and services: Research and compare advisor fees and services to find what works for you.

- Trust and communication: Choose a financial advisor who you trust and communicate well with. Good communication can ensure your investment goals are aligned with your advisor.

Remember, successful investing requires patience, discipline, and effort. Follow these steps and work with a financial advisor to achieve your financial goals.

Frequently Asked Questions

What Is A Budget And Why Do I Need One?

A budget is a financial plan that helps you track your income and expenses. It allows you to control your spending and prioritize your money towards achieving your financial goals. A budget is essential for managing your money effectively.

How Can I Create A Budget?

To create a budget, start by listing all your sources of income and expenses. Categorize your expenses into fixed and variable expenses. Total your income and expenses, and compare them to see if you can save money. Adjust your spending habits if necessary, and make saving a priority.

How Much Should I Save Each Month?

It is recommended to save at least 20% of your income each month. If you have debt, prioritize paying it off before saving. If you are not saving 20% currently, start by saving a smaller amount and gradually increase it over time.

How Can I Save Money On A Low Income?

To save money on a low income, start by tracking your expenses and creating a budget. Cut back on unnecessary expenses like dining out and entertainment. Look for ways to increase your income, such as taking on a side job or selling unused items.

Consider shopping at discount stores and buying used items.

What Are Some Common Budgeting Mistakes To Avoid?

Common budgeting mistakes to avoid include not tracking your expenses, not accounting for irregular expenses, not saving enough, and overspending on unnecessary items. Stick to your budget and adjust it as necessary, and don’t forget to celebrate your successes along the way.

Conclusion

Managing your money effectively is an essential life skill. Learning how to budget and save money can help you achieve your financial goals, reduce financial stress and improve your overall quality of life. By following the steps outlined in this article, you can start taking control of your finances today.

Remember, budgeting requires discipline and commitment, but the benefits are well worth the effort. Start by creating a budget plan, tracking your spending, cutting unnecessary expenses, and finding ways to increase your income. With consistency and perseverance, you can achieve financial stability and build a secure future for yourself and your family.

Make a conscious effort to keep your spending in check and continue to review and adjust your budget as necessary. With these tips, you are on your way to financial success!

Must Read:

- https://budgethit.com/which-of-the-following-is-a-capital-budgeting-decision/

- https://budgethit.com/where-to-stay-in-marthas-vineyard-on-a-budget/

- https://budgethit.com/where-to-stay-in-amalfi-coast-on-a-budget/

- https://budgethit.com/which-of-the-following-is-true-of-the-sales-budget/

- https://budgethit.com/which-of-the-following-is-not-true-about-capital-budgeting/

- https://budgethit.com/which-of-these-is-an-operating-budget-linkedin/

- https://budgethit.com/which-is-the-last-step-in-developing-the-master-budget/

- https://budgethit.com/what-was-the-budget-for-terrifier/

- https://budgethit.com/which-of-the-following-is-not-a-financial-budget/